Who owns copyright in something that’s part of the law? (Fair Dealing and Crown Copyright)

By Richard Stobbe

A certain code is adopted into law. Someone sells copies of that code, but they’re sued for copyright infringement. So… who owns the copyright? If the government owns copyright, then how can a reproduction of the law be considered infringement?  If the government does not own copyright, then how did the code become part of the law in the first place?

These are the vexing questions that the Federal Court of Appeal tackled in a new and interesting decision on Crown copyright and fair dealing.

In P.S. Knight Co. Ltd. v. Canadian Standards Association, 2018 FCA 222, the court reviewed  copyright issues surrounding the Canadian Electrical Code, which has been adopted by federal and provincial legislation: for example, in Alberta, the Electrical Code Regulation formally declares the Canadian Electrical Code, Part 1 (Twenty‑third edition) to be “in force” in the province in respect of electrical systems. This means that the Code is essentially part of the law of the land, and there are penalties for any failure to comply. In fact, Alberta, Newfoundland, Ontario and Yukon expressly require that the Canadian Electrical Code be made available to the public in some form.

This is a commercial dispute that stretches back to the late 1960s, when Knight began developing products that competed with the publications of the Canadian Standards Association (CSA). Knight even created a simplified version of the Code (the Electrical Code Simplified). Through a series of events, Knight eventually sought to reproduce and sell the entire Canadian Electrical Code as its own publication, at a discount, undercutting the CSA price.  That’s when the CSA sued for copyright infringement. The CSA obtained an order for Knight to deliver up all infringing copies of the Code, Part I (the CSA Electrical Code or the Code), and ordered Knight Co. to pay statutory damages and costs of close to $100,000.

Knight appealed.

The Federal Court of Appeal dismissed Knight’s appeal, deciding that the Code is protected by copyright, even though it was developed and authored by committee. Just because the CSA made the Code available to be part of the mandated standard for the country, this doesn‘t mean the CSA gave up its own copyright interests in the Code.  The court also found that the Crown did not own copyright in the Code. As for the defence of ‘fair dealing’, the court weighed the various factors – the purpose of the dealing, character of the dealing, amount of the dealing, alternatives to the dealing, nature of the work and the effect of the dealing. It the court’s analysis, these factors “overwhelmingly“ supported the conclusion that Knight’s copying and sale of the Code did not qualify as “fair dealing.â€

In a strong dissent, Justice Webb seemed to appreciate the absurdity of penalizing someone from reproducing a Canadian law.

“What is in issue in this case,†according to the dissent, “is the right to publish certain works that have become part of the laws of Canada. …. Since the Code was considered as part of the text of the Regulations when it was incorporated by reference, it is the same as if it had been reproduced in full in the Regulations and, therefore, is part of the Regulations. Since the Reproduction of Federal Law Order permits any person to copy any enactment, the Crown has already granted P.S. Knight Co. Ltd. the right to copy the Code.â€

Calgary – 07:00 MST

No comments

LEGO vs. LEPIN: Battle of the Brick Makers!

By Richard Stobbe

In any counterfeit battle involving the LEGO brand, we could have riffed off the successful line of LEGO Star Wars sets and made reference to the Attack of the Clones. But that’s been done, and anyway the recent legal battle between LEGO Group and a Chinese knock-off cut across more than just the Star Wars line: Shantou Meizhi Model Co., Ltd. essentially replicated the whole line of LEGO-brand products, including the popular Star Wars sets, licensed from Disney, the Friends line, the City, Technic and Creator product lines, as well as sets based on licensed movie franchises, like the Harry Potter and Batman lines. Lepin even sells a knock-off replica of the LEGO replica of the VW Camper Van, which sells under the “Lepin” brand for USD$48.00 (the Lego version sells for US$120).

In any counterfeit battle involving the LEGO brand, we could have riffed off the successful line of LEGO Star Wars sets and made reference to the Attack of the Clones. But that’s been done, and anyway the recent legal battle between LEGO Group and a Chinese knock-off cut across more than just the Star Wars line: Shantou Meizhi Model Co., Ltd. essentially replicated the whole line of LEGO-brand products, including the popular Star Wars sets, licensed from Disney, the Friends line, the City, Technic and Creator product lines, as well as sets based on licensed movie franchises, like the Harry Potter and Batman lines. Lepin even sells a knock-off replica of the LEGO replica of the VW Camper Van, which sells under the “Lepin” brand for USD$48.00 (the Lego version sells for US$120).

The LEGO Group recently announced a win in Guangzhou Yuexiu District Court in China, based on unfair competition and infringement of its intellectual property rights in 3-dimensional artworks of 18 LEGO sets, and a number of LEGO Minifigures. This resulted in an injunction prohibiting the production, sale or promotion of the infringing sets, and a damage award of RMB 4.5 million.

While this decision is hailed as a win for LEGO, and a blow in favour of IP rights enforcement in China, the commercial reality is that 18 sets is a drop in the proverbial ocean of counterfeits for LEGO. A quick spin around the Lepin website shows that there is a sprawling product line available to the marketplace, most of which are direct copies of the corresponding LEGO sets. These are copies in appearance at least, since the quality of the Lepin product is … different, when compared to the quality of LEGO branded merchandise, according to some online reviews.

The connectable plastic brick which was popularized by LEGO is not, in itself, protectable from the IP perspective (patents expired long ago, and the trademarks in the brick shape were struck down in Canada). This permits entry by competitors such as MEGA-BLOKS, a company that sells a virtually identical interlocking brick, but under a distinctive brand, with original set designs, and rival licensing deals of its own Рfeaturing the likes of Pok̩mon, Sesame Street, John Deere and Star Trek.

While the bricks are just bricks, the LEGO trademarks are protectable, and as LEGO established, so are the rights in three-dimensional set designs, packaging art and other elements that were shamelessly copied by the busy folks at Lepin.

Protection of market share is a complex undertaking, where an intellectual property strategy is one element.  Looking for advice on how to protect your business using IP as a tool? Contact our IP advisors to start the conversation.

Related Reading: Battle of the Blocks (looking at the battle between Lego and Mega Blocks in Canada).

Calgary – 07:00 MT

No comments

Smart Contracts (Part 3): Opportunities & Limits of Smart Contracts

.

By Richard Stobbe

In Part 1 (Can Smart Contracts Really be Smart?), we looked at “smart contracts”, what might be called “programmatically executed transactions” or PETs. This concept refers to computers programmed to automatically executes certain transaction steps, provided certain conditions are met, illustrated by the vending machine analogy.

In Part 2 (Smart Contracts (Part 2): Intermediaries? We Don’t Need No Stinkin’ Intermediaries!), we pointed out that users of private shared (DLT) ledger systems must be aware of the attendant costs of switching to new intermediaries, and the legacy costs of continued dependence on old intermediaries.  To borrow a phrase from The Who, “Meet the new boss… same as the old boss.” In other words, don’t be fooled into thinking that intermediaries will disappear; they merely change. Managing the intermediaries remains a challenge.

In this final instalment of our series, we look at the opportunities and limits of smart contracts. I want to emphasize a few points:

- Placing Smart Contracts in Context: First, it’s worth emphasizing that smart contracts or PETs are merely one element of the whole DLT permissioned ledger ecosystem. The smart contract enables and implements certain important transactional steps, but those steps fit within the broader context of a matrix of contractual relations between the participants. Many of those relationships will be governed by “traditional” contracts. This traditional contract architecture enables the smart contract workflow. The take-home point here is that traditional contracts will remain a part of these business relationships, just as intermediaries will remain part of business relations. Let me provide an example: the Apple iTunes ecosystem contains a number of programmatically executed transactions. When a consumer chooses a movie rental, a song download or a music subscription, the order fulfilment and payment processing is entirely automated by software. However, users cannot participate in that ecosystem, nor can Apple obtain content from content producers, without an overarching set of traditional contracts: end user license agreements, royalty agreements, content licenses, agreements with payment providers. Those traditional contracts enable the PET, just as the PET enables the final transaction fulfillment.

- Changing Smart Contracts: Once a PET is set loose, we think of it as a self-actuating contract: it cannot be changed or altered or stopped by humans. The inability of humans to intervene is seen as a positive attribute - it removes the capriciousness of individuals and guarantees a specific pre-determined machine-driven outcome. But what if the parties decide (humans being humans) that they want the contract to be suspended or altered? Where humans control the progression of steps, they can decide to change, stop or reverse at any point in the workflow. Of course we’re assuming that this is a change or reversal to which both parties agree. But what is the mechanism to hit “pause”, or change a smart contract once it’s in midflight?  That remains a challenge of smart contracts, particularly as PET workflows gain complexity using blockchain-based technologies.

- One solution may be found within those traditional contracts, which can be drafted in such a way that they allow for a remedy in the event of a change in circumstances to which both sides agree, even after the PET has started executing the steps it was told to execute. In other words, the machine may complete the tasks it was told to do, but the humans may decide (contractually) to control the ultimate outcome, based on a consensus mechanism that can override the machine after the fact. This does have risks – it injects uncertainty into the final outcome. It also carries benefits – it adds flexibility to the process.

- Another solution may be found in the notion of “hybrid contracts” which are composed in both machine-readable form (code) and human-readable form (legal prose). This allows the parties to implement the consensus using a smart contract mechanism, and at the same time allows the parties to open up and change the contract terms using more traditional contract methods.

- Terminating Smart Contracts: Finally, consider how one party might terminate the smart contract relationship. If the process is delegated to self-executing blockchain code, how can the relationship be terminated? Again, where one party retains the ability to unilaterally terminate a PET, the final outcome is uncertain, and one of the chief benefits of smart contracts is lost. Too much flexibility will undermine the integrity of the process. On the other hand, too much rigidity might slow adoption of certain smart-contract workflows, especially as transaction value increases. A multilateral permissioned mechanism to terminate the smart contract must be considered within the system. Participants in a smart contract permissioned ledger will also have to consider what happens with the data that sits on the (permanent, immutable) ledger after termination. When building the contract matrix, consider what is “ledgerized”, what remains in non-ledgerized participant databases, and what happens to the ledgerized data after contract termination.

If you need advice in this area, please get in touch with our Emerging Technology Group.

Calgary – 07:00 MST

1 commentWhat happens to IP on bankruptcy?

By Richard Stobbe

The government introduced changes to some of the rules governing what happens to intellectual property on bankruptcy. If it becomes law, Budget Bill C-86 would enact changes to the Bankruptcy and Insolvency Act (BIA) and the Companies’ Creditors Arrangement Act (CCAA) to clarify that intellectual property users can preserve their usage rights, even if:

- intellectual property rights are sold or disposed of in the course of a bankruptcy or insolvency proceeding, or

- if the trustee or receiver seeks to disclaim or cancel the license agreement relating to IP rights.

If the bankrupt company is an owner of IP, that owner has licensed the IP to a user or licensee, and the intellectual property is included in a sale or disposition by the trustee, the proposed changes in Bill C-86 make it clear that the sale or disposition does not affect the licensee’s right to continue to use the IP during the term of the agreement. This is conditional on the licensee continuing to perform its obligations under the agreement in relation to the use of the intellectual property.

The same applies if the trustee seeks to disclaim or resiliate the license agreement – such a step won’t impact the licensee’s right to use the IP during the term of the agreement as long as the licensee continues to perform its obligations under the agreement in relation to the use of the intellectual property.

These changes clarify and expand the 2009 rules in Section 65.11(7) of the BIA  and a similar provision in s. 32(6) of the CCAA. In particular, these amendments would extend the rules to cover sale, disposition, disclaimer or resiliation of an IP license agreement, whether by a trustee or a receiver.

This will solve the problem encountered in Golden Opportunities Fund Inc. v Phenomenome Discoveries Inc., 2016 SKQB 306 (CanLII), where the court noted that section 65.11(7) of the BIA was narrowly construed to only apply to trustees, and thus has no bearing on a court-appointed receivership.

Stay tuned for the progress of these proposed amendments.

Related Reading, if you’re into this sort of thing:

Calgary – 07:00 MST

1 commentCryptocurrency Decision: Enforcing Blockchain Rights

.

By Richard Stobbe

A seemingly simple dispute lands on the desk of a judge in Vancouver, BC. By analogy, it could be described like this:

- AÂ Canadian purchased 530 units of foreign currency #1 from a Singapore-based currency trader.

- By mistake, the currency trader transferred 530 units of currency #2 to the account of the Canadian.

- It turns out that 530 units of currency #1 are worth $780.

- You guessed it, 530 units of currency #2 are worth $495,000.

- Whoops.

- The Singaporean currency trader immediately contacts the Canadian and asks that the currency be returned, to correct the mistake.

Seems simple, right? The Canadian is only entitled to keep the currency worth $780, and he should be ordered to return the balance.

Now, let’s complicate matters somewhat. The recent decision in Copytrack Pte Ltd. v Wall, 2018 BCSC 1709 (CanLII), one of the early decisions dealing directly with blockchain rights, addresses this scenario but with a few twists:

Copytrack is a Singapore-based company which has established a service to allow copyright owners, such as photographers, to enforce their copyrights internationally. Copyright owners do this by registering their images with Copytrack, and then deploying software to detect instances of online infringement. When infringement is detected, the copyright owner extracts a payment from the infringer, and Copytrack earns a fee. This copyright enforcement business is not new. However, riding the wave of interest in blockchain and smart contracts, Copytrack has launched a new blockchain-based copyright registry coupled with a set of cryptocurrency tokens, to permit the tracking of copyrights using a blockchain ledger, and payments using blockchain-based cryptocurrency.  Therefore, instead of traditional fiat currency, like US dollars and Euros, which is underpinned by a highly regulated international financial services industry, this case involves different cryptocurrency tokens.

When Copytrack started selling CPY tokens to support their new system, a Canadian, Mr. Wall, subscribed for 580 CPY tokens at a price of about $780. Copytrack transferred 580 Ether tokens to his online wallet by mistake, enriching the account with almost half a million dollars worth of cryptocurrency. Mr. Wall essentially argued that someone hacked into his account and transferred those 530 Ether tokens out of his virtual wallet. Since he lacked control over those units of cryptocurrency, he was unable to return them to Copytrack.

The argument by Copytrack was based in an old legal principle of conversion – this is the idea that an owner has certain rights in a situation where goods (including funds) are wrongfully disposed of, which has the effect of denying the rightful owner of the benefit of those goods. With a stretch, the court seemed prepared to apply this legal principle to intangible cryptocurrency tokens, even though the issue was not really argued, legal research was apparently not presented, the proper characterization of cryptocurrency tokens was unclear to the court, the evidentiary record was inadequate, and in the words of the judge the whole thing “is a complex and as of yet undecided question that is not suitable for determination by way of a summary judgment application.”

Nevertheless, the court made an order on this summary judgement application. Perhaps this illustrates how usefully flexible the law can be, when it wants to be. The court ordered “that Copytrack be entitled to trace and recover the 529.8273791 Ether Tokens received by Wall from Copytrack on 15 February 2018 in whatsoever hands those Ether Tokens may currently be held.”

How, exactly, this order will be enforced remains to be seen. It is likely that the resolution of this particular dispute will move out of the courts and into a private settlement, with the result that these issues will remain complex and undecided as far as the court is concerned. A few takeaways from this decision:

- As with all new technologies, the court requires support and, in some cases, expert evidence, to understand the technical background and place things in context. This case is no different, but the comments from the court suggest something was lacking here: “Nowhere in its submission did Copytrack address the question of whether cryptocurrency, including the Ether Tokens, are in fact goods or the question of if or how cryptocurrency could be subject to claims for conversion and wrongful detention.”

- It is interesting to note that blockchain-based currencies, such as the CPY and Ether tokens at issue in this case, are susceptible to claims of hacking. “The evidence of what has happened to the Ether Tokens since is somewhat murky”, the court notes dryly. This flies in the face of one of the central claims advanced by blockchain advocates: transactions are stored on an immutable open ledger that tracks every step in a traceable, transparent and irreversible record. If the records are open and immutable, how can there be any confusion about these transfers? How do we reconcile these two seemingly contradictory positions? The answer is somewhere in the ‘last mile’ between the ledgerized tokens (which sit on a blockchain), and the cryptocurrency exchanges and virtual wallets (using ‘non-blockchain’ user-interface software for the trading and management of various cryptocurrency accounts). It may be infeasible to hack blockchain ledgers, but it’s relatively feasible to hack the exchange or wallet. This remains a vulnerability in existing systems.

- Lastly, this decision is one of the first in Canada directly addressing the enforcement of rights to ownership of cryptocurrency. Clearly, the law in this area requires further development – even in answering the basic questions of whether cryptocurrency qualifies as an asset covered by the doctrines of conversion and detinue (answer: it probably does). This also illustrates the requirement for traditional dispute resolution mechanisms between international parties, even in disputes involving a smart-contract company such as Copytrack. The fine-print in agreements between industry players will remain important when resolving such disputes in the future.

Seek experienced counsel when confronting cryptocurrency issues, smart contracts and blockchain-based rights.

Calgary – 07:00 MST

No comments#Illegal #Infringement : Defamation & Social Media

.

By Richard Stobbe

Can a hashtag constitute defamation?

In an Ontario case involving a music collaboration gone wrong, the answer apparently is yes. The dispute involved Mr. Johnson, who was allegedly a songwriter and music producer. Ms. Rakhmanova was also a song writer and signer. The two musicians collaborated on several tracks which were later the subject of a bitter dispute.

According to the judgement, Mr. Johnson released the tracks online, over the objections of Ms. Rakhmanova. At one point, after the songs were mixed and mastered, Ms. Rakhmanova requested that Mr. Johnson sign a recording contract, to memorialize the joint-authorship and ownership of the tracks, including equal publishing credit. Mr. Johnson refused to sign the contract since, according to the judgement, he intended to claim sole ownership over the three songs. Ms. Rakhmanova withdrew her consent to the release of her melodies and vocal tracks.  By then, however, the track had already been released online. Mr. Johnson failed to properly account for any revenue or royalties, and did not include proper attribution of Ms. Rakhmanova’s contributions: her picture and name were omitted from certain track names.

Ms. Rakhmanova then launched a series of online communications – through emails, Facebook, Twitter, Instagram accounts and SoundCloud posts – demanding removal of the content, and generally calling out Mr. Johnson for his conduct that, in her view, could be described as “…#stealing“, “infringing of my copyright“, “#piracy” “#plagiarism“, “#Infringement“, “#Illegal“, and characterizing Mr. Johnson as akin to “con artists who shamelessly peddle stolen acappellas“…

In Johnson v. Rakhmanova, 2018 ONSC 5258 (CanLII), the Court reviewed a defamation claim by Mr. Johnson, based on comments of this type. Interestingly, the Court flagged the defamatory elements in the various extracts, specifically highlighting certain hashtags such as “#piracy” “#plagiarism”, “#Infringement”, “#Illegal”. While none of the social media posts consisted of only hashtags (there was always more content included in the post), it is worth noting that, for certain posts, the judge highlighted the hashtag alone as constituting the only defamatory element. This suggests that, in the right context, a well-placed hashtag can constitute a defamatory statement.

A finding of defamation raises a presumption that the words complained of were false, that they were communicated with malice and that the plaintiff suffered damage.  That presumption of falsity is rebutted by the defendant proving truth or justification.  In the end, the Court took the view that most of these defamatory statements were accurate and truthful and therefore justified. And therefore not defamatory. The court dismissed Mr. Johnson’s defamation claim in any event, and awarded costs to Ms. Rakhmanova.

Calgary -7:00 MST

No commentsEnforcing Rights Online: Copyright Infringement & “Norwich Orders”

.

By Richard Stobbe

When a copyright owner seeks to enforce against online copyright infringement, it often faces a problem: who is engaging in the infringing activity?  If the old adage holds true – on the internet, nobody knows you’re a dog – then the corollary is that there must be a lot of canines engaged in online copyright infringement.

Of course a copyright owner can only enforce its rights against online infringement if it knows the identity of the infringer.  The Canadian solution, which is enshrined in the Copyright Act,  is the so-called “notice-and-notice” regime, which allows a copyright holder to send a notice to the ISP (internet service provider), and the ISP is obliged by the Copyright Act to send that notice to the alleged infringer, who still remains anonymous.  The notice of infringement is passed along… but the infringing content remains online.  Since the “notice-and-notice” regime is not much of an enforcement tool, the path eventually leads copyright holders to seek a court order (called a Norwich order) to disclose the identity of those alleged infringers.  (See our previous articles about Norwich Orders for background.)

In Rogers Communications Inc. v. Voltage Pictures, LLC, 2018 SCC 38, a film production company (Voltage) alleged copyright infringement by certain anonymous internet users. Allegedly, films were being shared using peer-to-peer file sharing networks. Yes, apparently peer-to-peer file sharing networks are still a thing. Voltage sued one anonymous alleged infringer and brought a motion for a Norwich order to compel the ISP (Rogers) to disclose the identity of the infringer.

Now we get to a practical problem: who pays for the disclosure of these records?

Pointing to sections 41.25 and 41.26 of the Copyright Act, Voltage argued that the disclosure order be made without anything payable to Rogers. In essence, Voltage argued that the “notice and notice†regime does two things: it creates a statutory obligation to forward the notice of claimed infringement to the anonymous infringer. The Act also prohibit ISPs from charging a fee for complying with these “notice-and-notice” obligations. In response, Rogers argued that there is a distinction between sending the notice to the anonymous infringer (for which it cannot charge a fee) and disclosing the identity of that (alleged) infringer pursuant to a Norwich order. The Act does not specify that ISPs are prohibited from charging a fee for this step.

The Supreme Court of Canada (SCC) agreed that there is a distinction to be made: on the one hand, an ISP has obligations under the Copyright Act to ensure the accuracy of its records for the purposes of the notice and notice regime, and on the other hand, an ISP may be obliged, under a Norwich order to actually identify a person from its records. In a nutshell, the court reasoned that ISPs must retain records under the Act, in a form and manner that permits an ISP to identify the name and address of the person to whom notice is forwarded for the “notice-and-notice” purposes. But the Act does not require that these records be kept in a form and manner which would permit a copyright owner or a court to identify that person.  The copyright owner would only be entitled to receive that kind of information from an ISP under the terms of a Norwich order. The Norwich order is a process that falls outside the ISP’s obligations under the notice and notice regime. In the end, an ISP can recover its costs of compliance with a Norwich order, but ISPs cannot be compensated for every cost that it incurs in complying with such an order:

“Recoverable costs must be reasonable and must arise from compliance with the Norwich order. Where costs should have been borne by an ISP in performing its statutory obligations under the notice and notice regime, these costs cannot be characterized as either reasonable or as arising from compliance with a Norwich order, and cannot be recovered.”

According to Rogers, there are eight steps in its process to disclose the identity of one of its subscribers in response to a Norwich order.  The SCC made reference to this eight-step process, but wasn’t in a position to decide which of these steps overlap with Rogers’ obligations under the Act (for which Rogers was not entitled to reimbursement) and the steps which are “reasonable costs of compliance” (for which Rogers was entitled to reimbursement). The question was returned to the lower court for determination.

For copyright owners, its clear that ISPs will not shoulder the entire cost of disclosing the identity of subscribers at the Norwich stage. How much of that cost will have to borne by copyright holders is, unfortunately, still not very clear.  For ISPs, this decision is a mixed bag – Rogers makes a solid argument that the costs of compliance with Norwich orders are relatively high, compared with the automated notice-and-notice procedures. While it will benefit ISPs to be able to charge some of these fees to the copyright owner, we don’t have clear guidance on the specifics.  The matter will have to be determined on a case-by-case basis, depending on the ISP and their own internal procedures.

Looking for advice on Norwich orders and enforcement against online copyright infringement? Look for experienced counsel to guide you through this process.

Calgary – 7:00 MST

No commentsOwnership of Inventions by Employees

By Richard Stobbe

A group of employees invented a patentable invention. Advanced Video obtained the patent,  and then moved to sue a competitor for infringement. The alleged infringer challenged Advanced Video’s right to sue, pointing out that Advanced Video did not have standing to sue for infringement, since it never obtained the transfer of patent rights from the employee-inventor.

The U.S. case Advanced Video Technologies LLC v. HTC Corporation reviews the narrow issue of whether a co-inventor of the patent transferred her co-ownership interests in the patent under the terms of an employment agreement.

The patent in question listed three co-inventors: Benny Woo, Xiaoming Li, and Vivian Hsiun. The invention was created while the three co-inventors were employed with Infochips Systems Inc. (“Infochips”), a predecessor of Advanced Video. Through a series of steps, two of the inventors, Mr. Woo and Ms. Li assigned their coownership interests in the patent to Advanced Video. The co-ownership interests of Ms. Hsiun were the subject of this lawsuit. Advanced Video claimed that it obtained Ms. Hsiun’s co-ownership interests in the invention through the original employment agreement with that employee.

A review of Ms. Hsiun’s employment agreement indicated that the clause in question was pretty clear:

I agree that I will promptly make full written disclosure to the Company, will hold in trust for the sole right and benefit of the Company, and will assign to the Company all my right, title, and interest in and to any and all inventions, original works of authorship, developments, improvements or trade secrets which I may solely or jointly conceive or develop or reduce to practice, or cause to be conceived or developed or reduced to practice, during the period of time I am in the employ of the Company. (Emphasis added)

For emphasis, the employment agreement went on to say:

I hereby waive and quitclaim to the Company any and all claims, of any nature whatsoever, which I now or may hereafter have infringement [sic] of any patents, copyrights, or mask work rights resulting from any such application assigned hereunder to the Company. (Emphasis added)

Translation? The employee agrees that she will assign to the employer all rights to any and all inventions developed by the employee during employment.

Surprisingly, the court decided this language did not clearly convey the rights to the invention, since the word “will” invoked a promise to do something in the future and did not effect a present assignment of the rights.

This was merely a promise to assign, not an actual immediate transfer of the invention.

While this is a U.S. case, it neatly illustrates the risks associated with the fine print in employment agreements: to avoid the problem faced by Advanced Video, it’s valuable for employment agreements to automatically and immediately assign and transfer rights to inventions, and to avoid any language that suggests a future obligation or future promise to assign.

The lesson for business in any industry is clear: ensure that your employment agreements – and by extension, independent contractor and consulting agreements – are clear. Intellectual property and ownership of inventions should be clearly addressed. Get advice from experienced counsel to ensure that the IP legal issues are covered – including confidentiality, consideration, invention ownership, IP assignment, non-competition and non-solicitation.

Related Reading: Â Employee Ownership of Patentable Inventions

Calgary – 07:00 MST

No comments

CASL Enforcement: The Anti-Malware Provisions

By Richard Stobbe

Canada’s Anti-Spam Law (affectionately known as CASL) is best known as a means to combat unwanted email and other commercial electronic messages, but the law also contains anti-malware provisions. We first reviewed those software-related provisions in 2014, when the legislation was being rolled out. Essentially, you can’t install software onto someone’s computer or device without getting their consent.

The CRTC recently announced an enforcement action against two Ontario companies, Datablocks and Sunlight Media, and assessed a Notice of Violation carrying penalties of $250,000, for allegedly aiding in the installation of malware through the distribution of online advertising. The penalty can be disputed by the two companies.

This recent notice of a possible penalty comes hot on the heels of a search warrant which was executed in January, 2016. So, that means the legislation came into force in January, 2015… the first search warrant was in 2016… the first penalties were assessed in July 2018. Not exactly an enforcement blitz.

Perhaps the take-home message from this case is that the companies in question are alleged to have accepted anonymous clients who then deployed malware to the computer systems of Canadians using the infrastructure and operations of Datablocks and Sunlight Media. It may be good practice for vendors to implement some version of the “know your client” rules that currently apply to banks, financial advisors, lawyers and other professional advisors. At a minimum, compliance should involve written agreements with clients or customers, and according to the CRTC, neither Datablocks nor Sunlight had written contracts in place with their clients regarding compliance with CASL, or monitoring measures in place to guard against this risk.

Calgary – 07:00

No commentsCan an old trademark be reborn… with a new owner?

By Richard Stobbe

When a Canadian woman looked to buy CUBAN LUNCH brand chocolate bars for her mother, she found the product was discontinued.

It appears that an Albertan, Crystal Regehr Westergard, saw an entrepreneurial opportunity.  After realizing the product had been abandoned by the original manufacturer, and the Winnipeg factory that made Cuban Lunch closed down nearly three decades ago, she decided to remake the product herself, and revive the trademark. The original trademark CUBAN LUNCH was registered in Canada in 1983 for “Confectionery namely chocolate bars”, claiming use in Canada since December 1948. After being passed through a number of different owners throughout the late 1990s up until 2013, the original trademark was finally expunged from the register at the Canadian Intellectual Property Office in 2015 for failure to renew. 1948-2015. Not a bad run for a candy bar brand.  This is usually the end of the line for an aging trademark, where the product has been discontinued.

The Westergards submitted a new trademark application to the Canadian Intellectual Property Office for the CUBAN LUNCH trademark, listing the same goods, and claiming use since May 2017.

This raises an interesting trademark question: Can an old, retired trademark be reborn with a new owner?

In Canada, trademark rights are based on use. Once use begins, trademark rights come alive. When use ceases, trademark rights die out. It’s important to remember that the registered rights recorded in the trademarks office are merely reflective of the actual use of that mark in the marketplace.  To use the more eloquent phrasing of the Supreme Court of Canada: “Registration itself does not confer priority of title to a trade-mark. At common law, it was use of a trade-mark that conferred the exclusive right to the trade-mark. While the Trade-marks Act provides additional rights to a registered trade-mark holder than were available at common law, registration is only available once the right to the trade-mark has been established by use.” (Emphasis added) (Masterpiece Inc. v. Alavida Lifestyles Inc., [2011] 2 SCR 387, 2011 SCC 27 (CanLII))

Trademark rights lapse and die all the time, where the rights are no longer used, and are therefore legally extinguished. In theory, there is no reason why a new business owner cannot commence use of a “dead” mark and notionally adopt that mark as their own, breathing new life into the trademark rights through their own use of the mark with their own product. Of course, it’s important to note that even if registered rights lapse (for example, for failure to pay renewal fees), the underlying common law rights might continue. Let’s say a registration lapsed because of a clerical oversight; this oversight alone would not impact the underlying commercial use of the mark which might be alive and well. As noted above, registration is merely an official recordal of the rights endowed by actual use.

In the case of the CUBAN LUNCH mark, the reports appear to indicate that the original mark suffered a death both in actual commercial use and in registration. If that’s the case, then the original trademark is no longer a trademark, and those words are free to be adopted by a new owner.

Now… it’s high noon. Where do we buy a CUBAN LUNCH ?

Calgary – 07:00

No comments

Smart Contracts (Part 2): Intermediaries? We don’t need no stinkin’ intermediaries!

By Richard Stobbe

In Part 1 (Can Smart Contracts Really be Smart?), we looked at smart contracts, and how “smart” they really are – if you need some background, start there.

Smart contracts (or “programmatically executed transactions”) have been touted as a possible solution to a range of business problems, as well as the death knell for intermediaries. By deploying DLT on a private shared ledger, the power of the blockchain is harnessed to leapfrog past traditional intermediaries. This enables more efficient transactions, free from the constraints and incremental expenses imposed by banks, auditors, governments, regulators, lawyers, accountants and others who take a pound of flesh from the transaction workflow.

By shuffling off the intermediaries, the smart contract is free to move efficiently in the economy, saving time and money for participants. To adapt a phrase from the Humphrey Bogart vehicle The Treasure of Sierra Madre: Intermediaries? We don’t need no stinkin’ intermediaries! At least… that’s the current hope for blockchain-powered smart contracts.

Are there any concerns with this vision? One of the current constraints in the smart contract ecosystem is the gap between tokenized indicators of value on the ledger, and the almighty dollar. Or the euro. The pound sterling. The yen. The yuan. Or whatever fiat currency you may wish to use to transact business in the real world. As much as we’d like to envision a post-money world, the reality is like the QWERTY keyboard. Or the Microsoft operating system. It may not be the best. But it’s got massive market penetration. In the case of the QWERTY keyboard, we’ve been stuck with it since the 1800s. In the case of  money as a currency, since the 11th century.

Ten centuries of market inertia is not easy to shift.

That gap – between the digital representations of value, and real world money – must be efficiently closed for smart contracts to gain widespread traction. Maybe eventually we’ll move past “money” in the way voice-activation moves past the QWERTY keyboard. But that’s a long way off.

In the meantime, smart contracts powered by DLT will have to peg a tokenized “dollar” to a real dollar in the sense that the token is backed by the dollar: this is the concept of a fiat-collateralized digital representation of a real dollar, or a stablecoin. “You deposit dollars into a bank account and issue stablecoins 1:1 against those dollars.” This has obvious advantages over a crypto-collateralized coin, which suffers from wildly unpredictable price fluctuations. A stablecoin is simple and resistant to price-volatility. However, “It requires centralization in that you have to trust the custodian, so the custodian must be trustworthy. You’ll also want auditors to periodically audit the custodian, which can be expensive.”

But wait, we already have a trusted centralized custodian of collateralized digital representations of value: It’s called a bank!

As noted in Blockchain and Shared Ledgers: “You could say that the technology service provider is replacing the traditional third party intermediary on a private shared ledger – in the way that they are maintaining and operating the shared ledger technology systems …” (My emphasis).

To put this another way, does this mean software companies are the new banks? The concern here is that users of private shared ledgers will not shuffle off intermediaries; rather they’ll swap one intermediary for another.

I’m just as happy as the next guy to grumble about banks, but they will likely be with us for a while, complete with the government regulatory environment, the industry watchdogs, the legacy payment rails, and centuries of inertia. I’m not saying the banks can’t be disrupted. But the disruptors will also take their pound of flesh.

Ok, maybe we do need intermediaries after all. Users of private shared ledger systems must be aware of the attendant costs of switching to new intermediaries, and the legacy costs of continued dependence on old intermediaries. Where smart contracts on private shared ledger platforms can efficiently bridge the gap with traditional payment ecosystems , there will be some fruitful opportunities.

Looking for legal advice on smart contracts, DLT and private ledger consortium? Contact the Field Law Emerging Technology Group.

Calgary – 07:00 MT

No comments

IP Assets After Death (Part 1)

By Richard Stobbe

Can an inventor be granted a patent posthumously?

The answer is a clear yes, as illustrated by the experience of one well-known inventor: Steve Jobs is named as an inventor on hundreds of U.S. utility and design patents, over 140 of which have been awarded since his death in 2011. The Patent Act provides for a patent to issue after the death of the inventor, and the issued patent rights would be treated  like any other asset of the inventor’s estate.

The Patent Act refers to “legal representatives†of an inventor which includes “heirs, executors, …assigns,… and all other persons claiming through or under applicants for patents and patentees of inventions.â€

There are a few important implications here: A patent may be granted posthumously to the personal representatives of the estate of the deceased inventor.

This also means that executors of the estate of a deceased inventor are entitled to apply for and be granted a patent under the Act. Employers can also benefit from patent rights granted in the name of a deceased inventor, where those rights have been assigned under contract during the life of the inventor, such as a contract of employment.

The term of the patent rights remain the same: 20 years from the filing date, regardless of the date of death of the inventor.

There are well-established rules on filing protocols in the case of deceased inventors, in both national and international phase applications: make sure you seek experienced counsel when facing this situation.

Calgary – 07:00 MST

No comments

BEER BEER as a trademark… for “beerâ€?

By Richard Stobbe

There is a rule in Canadian trademarks law that you can’t get a trademark for a word that describes the product you’re selling. Makes sense, right? No-one should have a monopoly over a word that is descriptive of the thing they’re selling. Such a term should be open to everyone to use.

Drummond Brewing applied to register BEER BEER as a trademark for “beerâ€.  Wait, let’s re-read the paragraph above. Isn’t BEER BEER clearly descriptive when used in association with the sale of beer?  Drummond, apparently, did not think so when it filed its application claiming use since 2009. They held this opinion despite an earlier decision (Coors Global Properties, Inc. v. Drummond Brewing Company, 2011 TMOB 44 (March 11, 2011)) which found BEER BEER to be clearly descriptive.

There is well-known decision from the early 1980s (Pizza Pizza Ltd. v. Registrar of Trade Marks (1982), 67 C.P.R. (2d) 202), where the court decided that the mark PIZZA PIZZA was found not to be clearly descriptive of “pizza†since the expression PIZZA PIZZA was not a linguistic construction that is a part of normally acceptable spoken or written English. If it works for pizza, why not beer?

In the decision Molson Canada 2005 v Drummond Brewing Company Ltd., 2017 TMOB 78 (CanLII),  Molson opposed this trademark, and Drummond fought back, insisting that the mark was not descriptive. Numerous experts from both sides weighed in on the meaning of the term BEER BEER as a linguistic construction. One expert provided an opinion as a sociolinguist after  consulting scholarly literature, fellow linguists, and the Corpus of English Contrastive Focus Reduplications, a collection of 203 examples of naturally occurring utterances featuring contrastive reduplicative constructions, as published in the scholarly journal Natural language and Linguistic Theory (NLLT), 2004.

I’m not making this stuff up.

In the end, common-sense prevailed and the decision-maker found that the mark BEER BEER was clearly descriptive of the product. The mark was found to be unregistrable as a trademark.

Calgary – 07:00 MST

No comments

Google vs. Equustek: Google Loses Another Round

By Richard Stobbe

How far can Canadian courts reach when making orders that seek to control the conduct of foreign companies outside of Canada? This controversial question is still being decided, bit by bit, in both Canadian and US courts. In our past posts we have written about a 2014 pre-trial temporary court order that required Google to de-index certain sites from Google’s worldwide search results, based on an underlying lawsuit that the plaintiff, Equustek, brought against the defendants back in 2011.  Google challenged the order requiring it to delist worldwide search results, and fought this order all the way up to the Supreme Court of Canada… where Google lost.

On July 24, 2017, approximately one month after the SCC decision, Google filed a complaint in US Federal Court, seeking an order that the injunction issued by the BC court is unlawful and unenforceable in the United States. That order was granted, first on a preliminary application on November 2, 2017 and then in a final ruling on December 14, 2017. With that US court decision in hand, Google came back to the BC court which had issued the original order, to vary the scope of that order.

On April 16, 2018, in Equustek Solutions Inc. v Jack, 2018 BCSC 610 (CanLII), the BC court again rejected Google’s requests. The BC court said that the US decision (which was in Google’s favour) did not establish that the injunction requires Google to violate American law. And without any significant change in circumstances, the court reasoned, there was no reason to change the original order. As a result, the temporary order against Google – which has been in place since 2014 – remains in place, pending outcome of the trial.

The outcome of that trial will be closely watched. As I mentioned in my earlier article, there has been very little analysis of Equustek’s IP rights by any of the different levels of court. Since this entire case involved pre-trial remedies, the merits of the underlying allegations and the strength of Equustek’s IP rights have never been tested at trial. In order for the injunction to make sense, one must assume that the IP rights were valid. Even if they are valid, it is questionable whether Equustek’s rights are worldwide in nature since there was no evidence of any worldwide patent rights or international trademark portfolio. We can only hope that the trial decision, and Google’s decision to appeal the latest BC court decision, will clarify these issues.

Calgary – 07:00 MDT

No commentsArtist Sues for Infringement of “Moral Rights”

By Richard Stobbe

AÂ professional photographer sued the gallery that sold his works, and won a damage award for copyright infringement, infringement of moral rights, and punitive damages. In this case (Collett v. Northland Art Company Canada Inc., 2018 FC 269 (CanLII)), Mr. Collett, the photographer, alleged that his former gallery, Northland, infringed his rights after their business relationship broke down.

We don’t see many “moral rights” infringement cases in Canada, so this case is of interest for artists and other copyright holders for this reason alone. What are “moral rights”?

In Canada the Copyright Act tells us that the author of a work has certain rights to the integrity of the work, the right to be associated with the work as its author by name or under a pseudonym and the right to remain anonymous.

These so-called moral rights of the author to the integrity of a work can be infringed where the work is “distorted, mutilated or otherwise modified” ina way that compromises or prejudices the author’s honour or reputation, or where the work is used in association with a product, service, cause or institution that harms the authors reputation. Determining infringement has a highly subjective aspect, which must be established by the author. But this type of claim also has an objective element requiring a court to evaluate the prejudice or harm to the author’s “honour or reputation” which can be supported by public or expert opinion.

Here, the court found that the gallery had infringed Mr. Collett’s moral rights when the gallery intentionally reproduced one print entitled “Spirit of Our Land†and attributed the work to another artist. By reproducing “Spirit of Our Land†without Mr. Collett’s permission, the gallery infringed the artist’s copyright in the work. By attributing the reproductions to another artist, the gallery infringed the artist’s moral right “to be associated with the work as its authorâ€. This is actually a useful illustration of the difference between these different types of artist’s rights.

The unauthorized reproductions sold by the gallery were apparently taken from a copy resulting in images of lower resolution and therefore inferior quality, compared to authorized prints; unfortunately, we don’t have any insight into whether inferior quality would also infringed the artist’s moral right to the integrity of the work. The court declined to comment on this aspect since it had already concluded that moral rights were infringed when the prints were sold under the name of another artist.

Lastly, and interestingly, the court found that a link from the gallery’s site to the artist’s website constituted an infringement of copyright. It’s difficult to see how a link, without more, could constitute a reproduction of a work, unless the linked site was somehow framed or otherwise replicated within the gallery’s site. The evidence is not clear from reading the decision but the artist’s allegation was that the gallery “reproduced the entirety” of certain pages from the artist’s site, which created the false impression that the gallery still represented the artist. The court noted that the gallery continued to maintain a link to Mr. Collett’s website “knowing it was not authorized to do so.” By doing so, the gallery infringed the artist’s copyright in his site, including a reproduction of certain prints. Maintaining such a link was not found to constitute a breach of the artist’s moral rights.

In the end, statutory damages of $45,000 were awarded for breach of copyright, $10,000 for infringement of moral rights, and $25,000 for punitive damages to punish the gallery for its planned, deliberate and ongoing acts of infringement.

Calgary – 07:00 MST

No commentsCanadian Beer Trademarks: When is a moose just a moose?

HEAD OF MOOSE DESIGN

By Richard Stobbe

When is a moose just a moose?

Apparently when it is reclined in a parlour sipping gin.

In Moosehead Breweries Limited v Eau Claire Distillery Ltd., 2018 TMOB 24 (CanLII), Canadian brewer Moosehead Breweries, the oldest, privately owned, independent brewery in Canada complained about confusion based on its well-known moose marks for beer (including Registration number TMA667312, as shown above).

Moosehead alleged that the PARLOUR GIN DESIGN for gin (Application No. 1,667,113) owned by Alberta’s own Eau Claire Distillery Ltd., was confusing with Moosehead’s own moose marks for beer.  In Eau Claire’s mark, an anthropomorphic moose character and anthropomorphic bear character are seated in formal clothing amidst Victorian parlour furnishings, sipping gin and engaging in polite conversation. Does the use of the moose for gin make this mark confusing with Moosehead’s brand for beer?

Canadian courts tell us that the test for confusion is “a matter of first impression in the mind of a casual consumer somewhat in a hurry who sees the [mark], at a time when he or she has no more than an imperfect recollection of the [prior] trade-marks, and does not give pause to give the matter any detailed consideration or scrutiny, nor to examine closely the similarities and differences between the marks.”

In this case, the decision-maker dismissed Moosehead’s opposition, after going through the factors, namely: (a) the inherent distinctiveness of the trade-marks and the extent to which they have become known; (b) the length of time each has been in use; (c) the nature of the goods, services or business; (d) the nature of the trade; and (e) the degree of resemblance between the trade-marks in appearance or sound or in the ideas suggested by them. There is no reasonable likelihood of confusion since the marks bear little resemblance in appearance, sound, and in the ideas suggested by them.

Moosehead’s challenge was rejected, and the Eau Claire mark will proceed.

Calgary – 07:00 MST

No commentsFacebook at the Supreme Court of Canada: forum selection clause is unenforceable

By Richard Stobbe

We just wrote about a dispute resolution clause that was enforceable in the Uber case. Last year, a privacy class action claim landed in the Supreme Curt of Canada (SCC) and I see that we haven’t had a chance to write this one up yet.

In our earlier post ( Facebook Follows Google to the SCC  ) we provided some of the background: The plaintiff Ms. Douez alleged that Facebook used the names and likenesses of Facebook customers for advertising through so-called “Sponsored Storiesâ€. The claim alleged that Facebook ran the “Sponsored Stories†program without the permission of customers, contrary to of s. 3(2) of the B.C. Privacy Act. The basic question was whether Facebook’s terms (which apply California law) should be enforced in Canada or whether they should give way to local B.C. law. The lower court accepted that, on its face, the Terms of Service were valid, clear and enforceable and the lower court went on to decide that Facebook’s Forum Selection Clause should be set aside in this case, and the claim should proceed in a B.C. court. Facebook appealed that decision: Douez v. Facebook, Inc., 2015 BCCA 279 (CanLII) (See this link to the Court of Appeal decision). The appeal court reversed and decided that the Forum Selection Clause should be enforced. Then the case went up to the SCC.

In Douez v. Facebook, Inc., [2017] 1 SCR 751, 2017 SCC 33 (CanLII), the SCC found that Facebook’s forum selection clause is unenforceable.

How did the court get to this decision?  Um…. hard to say, even for the SCC itself, since there was a 3-1-3 split in the 7 member court, with some judges agreeing on the result, but using different reasoning, making it tricky to find a clear line of legal reasoning to follow. The court endorsed its own “strong cause” test from Z.I. Pompey Industrie v. ECU-Line N.V., 2003 SCC 27 (CanLII): When parties agree to a jurisdiction for the resolution of disputes, courts will give effect to that agreement, unless the claimant establishes strong cause for not doing so. Here, the Court tells us that public policy considerations must be weighed when applying the “strong cause” test to forum selection clauses in the consumer context. The public policy factors appear to be as follows:

- Are we dealing with a consumer contract of adhesion between an individual consumer and a large corporation?

- Is there a “gross inequality of bargaining power” between the parties?

- Is there a statutory cause of action, implicating the quasi-constitutional privacy rights? These constitutional and quasi-constitutional rights play an essential role in a free and democratic society and embody key Canadian values, so this will influence the court’s analysis.

- The court will also assess “the interests of justice” and decide which court is better positioned to assess the purpose and intent of the legislation at issue (as in this case, where there was a statutory cause of action under the BC Privacy Act).

- Lastly, the court will assess the expense and inconvenience of requiring an individual consumer to litigate in a foreign jurisdiction (California, in this case), compared to the comparative expense and inconvenience to the big bad corporation (Facebook, in this case).

The court noted that, in order to become a user of Facebook, a consumer “must accept all the terms stipulated in the terms of use, including the forum selection clause. No bargaining, no choice, no adjustments.” But wait… Facebook is not a mandatory service, is it? The fact that a consumer’s decision to use Facebook is entirely voluntary seems to be missing from the majority’s analysis. A consumer must accept the terms, yes, but there is a clear choice: don’t become a user of Facebook. That option does not appear to be a factor in the court’s analysis.

The take-home lesson is that forum selection clauses will have to be carefully handled in consumer contracts of adhesion. It is possible that this decision will be limited to these unique circumstances.

Calgary – 07:00 MST

No commentsIP Protection in the Fashion and Apparel Industry (Part 3)

By Richard Stobbe

As noted in Part 1 and Part 2, IP rights in the fashion and apparel industry are fiercely contested. Fashion products can be protected in Canada using a number of different IP tools, including:

- confidential information

- patents

- industrial design or “design patentâ€

- trademarks

- trade dress

- copyright

- personality rights.

In the final part, we review the next couple of areas:

- Copyright

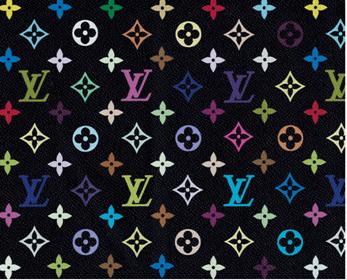

Copyright is a very flexible and wide-ranging tool to use in the fashion and apparel industry.  Under the Copyright Act, a business can use copyright to protect original expression in a range of products including artistic works, fabric designs, two and three-dimensional forms, and promotional materials, such as photographs, advertisements, audio and video content. For example, in Louis Vuitton Malletier S.A. et al. and Singga Enterprises (Canada) Inc., the Federal Court sent a strong message to counterfeiters. This was a case of infringement of copyright , arising from the sale of counterfeit copies of Louis Vuitton and Burberry handbags through online sales and operations in Vancouver, Calgary and Edmonton. Louis Vuitton owns copyright in the following Multicolored Monogram Print pattern:

Since the Copyright Act provides for an award of both damages and profits from the sale of infringing goods, or statutory damages between $500 to $20,000 per infringed work, the copyright owner had a range of options available to enforce its IP rights. In this case, the Federal Court awarded Louis Vuitton and Burberry a total of over $2.4 million in damages against the defendants, catching both the corporate and personal defendants in the award.

- Personality Rights

In Canada, the use of a famous person’s personality for commercial gain without authorization can lead to liability for “misappropriation of personalityâ€. To establish a case of misappropriation of personality, three elements must be shown:

- The exploitation of personality is for a commercial purpose.

- The person in question is identifiable in the context; and

- The use of personality suggests some endorsement or approval by the person in question.

Just ask William Shatner who objected on Twitter when his name and caricature were used to promote a condo development in Ontario, in a way that suggested that he endorsed the project.

Canadian personality rights benefit from some protection at the federal level through the Trademarks Act and the Competition Act, and are protected in some provinces. B.C., Saskatchewan, Manitoba and Quebec have privacy statutes that restrict the unauthorized commercial use of personality, although the various provincial statutes approach the issue slightly differently. Specific advice is required in different jurisdictions, depending on the circumstances.

Calgary – 07:00 MST

No commentsGoogle vs. Equustek Saga: The Final Countdown

By Richard Stobbe

Last month we asked: The Google vs. Equustek Decision: What comes next?

Part of the answer was handed down recently by a B.C. court in Equustek Solutions Inc. v Jack, 2018 BCSC 329 (CanLII), after Google applied to vacate or vary the original order of Madam Justice Fenlon, which was granted way back in 2014. That was the order that set off a furious international debate about the reach of Canadian courts, since it required Google to de-index certain sites from Google’s worldwide search results, based on an underlying lawsuit that the plaintiff Equustek brought against the defendants (which is finally set for trial in April, 2018).

Google of course was always invited to seek a variation of that original court order. As noted by the latest judgment, that right to apply to vary has been recognized by the B.C. Court of Appeal and the Supreme Court of Canada. After Google received a favourable decision last year from a US court, the way was paved to vary the original order that has caused Google so much heartburn. The next step is that Google will seek a cancellation or limitation of the scope of that original order, so that the order applies only to search results in Canada through google.ca.

The last step, with luck, will be a hearing of the merits of the underlying IP claims; some commentators have questioned why Google was used to obtain a practical worldwide remedy when the IP rights asserted by Equustek do not appear to be global in scope. As I mentioned in my earlier article, there has been very little analysis of Equustek’s IP rights by any of the different levels of court. Since this entire case involved pre-trial remedies, the merits of the underlying allegations and the strength of Equustek’s IP rights have never been tested at trial. In order for the injunction to make sense, one must assume that the IP rights were valid. Even if they are valid, Equustek’s rights couldn’t possibly be worldwide in nature. There was no evidence of any worldwide patent rights or international trademark portfolio. So, the court somehow skipped from “the internet is borderless†to “the infringed rights are borderless†and are deserving of a worldwide remedy.

To be continued…

Calgary – 07:00 MST

No comments

Uber vs. Drivers: Canadian Court Upholds App Terms

.

By Richard Stobbe

One of Uber’s drivers, an Ontario resident named David Heller, sued Uber under a class action claim seeking $400 million in damages. What did poor Uber do to deserve this? According to the claim, drivers should be considered employees of Uber and entitled to the benefits of Ontario’s Employment Standards Act (See: Heller v. Uber Technologies Inc., 2018 ONSC 718 (CanLII)).

As the court phrased it, while “millions of businesses and persons use Uber’s software Apps, there is a fierce debate about whether the users are customers, independent contractors, or employees.” If all of the drivers are to be treated as employees, the costs to Uber would skyrocket. Uber, of course, resisted this lawsuit, arguing that according to the app terms of service, the drivers actually enter into an agreement with Uber B.V., an entity incorporated under the laws of the Netherlands. By clicking or tapping “I agree” in the app terms of service, the drivers also accept a certain dispute resolution clause: by contract, the parties pick arbitration in Amsterdam to resolve any disputes.

Really, at this stage Uber’s defence was not to say “this claim should not proceed because all of the drivers are independent contractors, not employees”. Rather, Uber argued that “this claim should not proceed because all of the drivers agreed to settle disputes with us by arbitration in the Netherlands.”

So the court had to wrestle with this question:  Should the dispute resolution clause in the click-through terms be upheld? Or should the drivers be entitled to have their day in court in Canada?Â

The law in this area is very interesting and frankly, a bit muddled. This is because there are two distinct issues in this legal thicket: a forum-selection clause (the laws of the Netherlands govern any interpretation of the agreement), and a dispute resolution clause (here, arbitration is the parties’ chosen method to resolve any disputes under the agreement). For these two different issues, Canadian courts have applied different tests to determine whether such clauses should be upheld:

- In the case of forum selection clause, the Supreme Court of Canada (SCC) tells us that the rule from Z.I. Pompey Industries is that a forum selection clause should be enforced unless there is “strong cause†not to enforce it.  In the context of a consumer contract (as opposed to a “commercial agreement”), the SCC says there may be strong reasons to refrain from enforcing a forum selection clause (such as unequal bargaining power between the parties, the convenience and expense of litigation in another jurisdiction, public policy reasons, and the interests of justice). In the commercial context (as opposed to a consumer agreement), forum selection clauses are generally upheld.

- In the case of upholding arbitration clauses, the courts have applied a different analysis: arbitration is generally favoured as a means to settle disputes, using the “competence-competence principle”. Again, it’s an SCC decision that gives us guidance on this: unless there is clear legislative language to the contrary, or the dispute falls outside the scope of the arbitration agreement, courts must enforce arbitration agreements.

The court said this case “is not about a discretionary court jurisdiction where there is a forum selection clause to refuse to stay proceedings where a strong cause might justify refusing a stay; rather, it is about a very strong legislative direction under the Arbitration Act, 1991 or the International Commercial Arbitration Act, 2017 and numerous cases that hold that courts should only refuse a reference to arbitration if it is clear that the dispute falls outside the arbitration agreement.”

Applying the competence-competence analysis, the court (in my view) properly ruled in favour of Uber, upheld the app terms of service, and deferred this dispute to the arbitrator in the Netherlands. This class action, as a result, must hit the brakes.

The decision is reportedly under appeal.

Calgary – 07:00 MST

1 comment